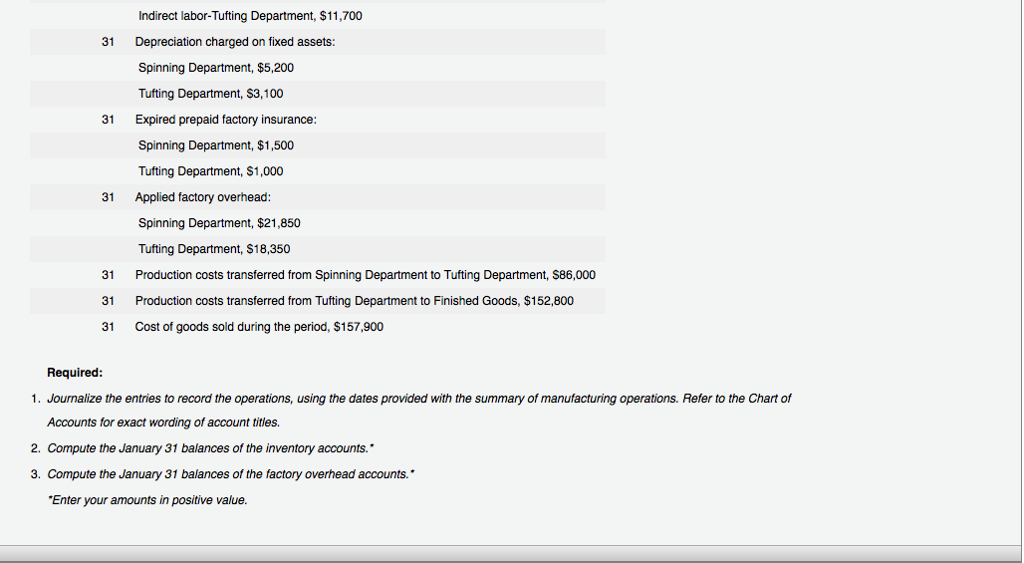

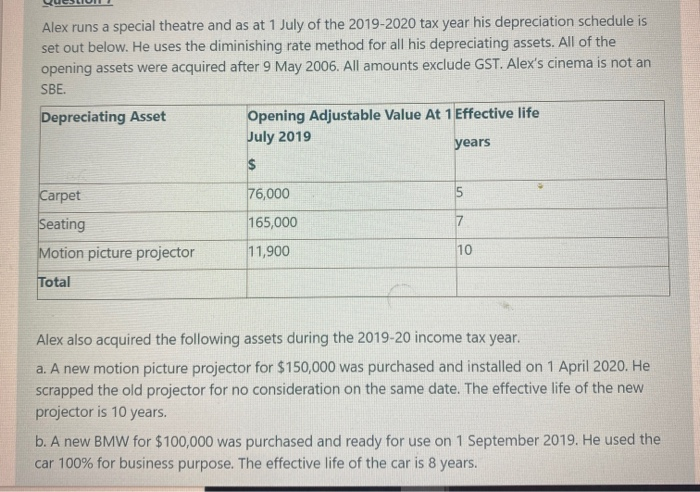

Depreciated Value Carpet

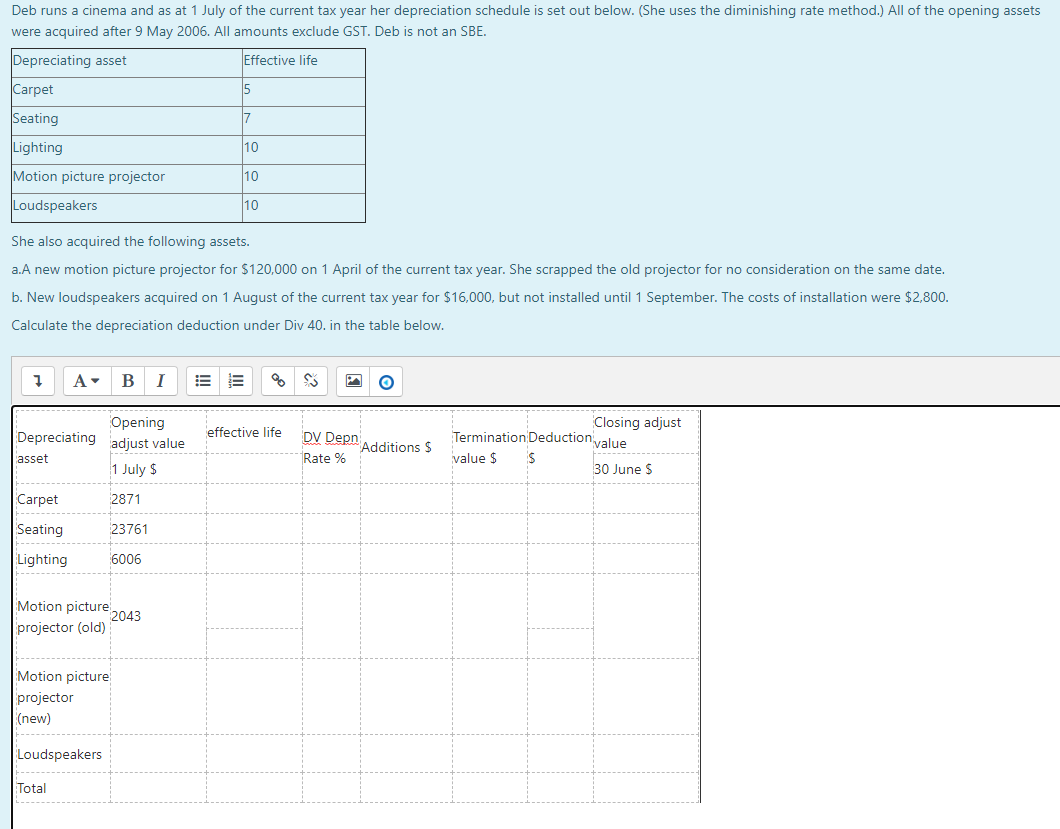

Expected life of carpet.

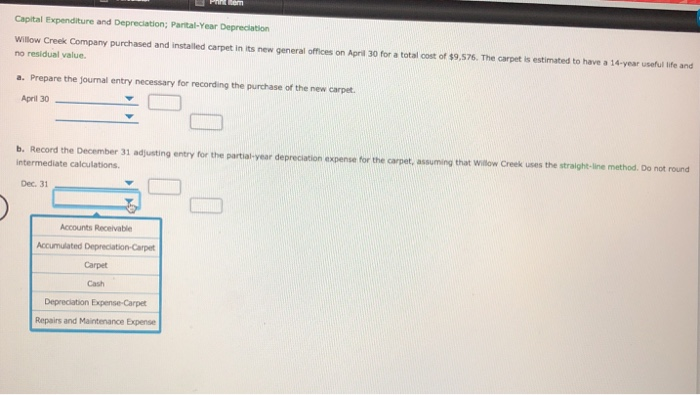

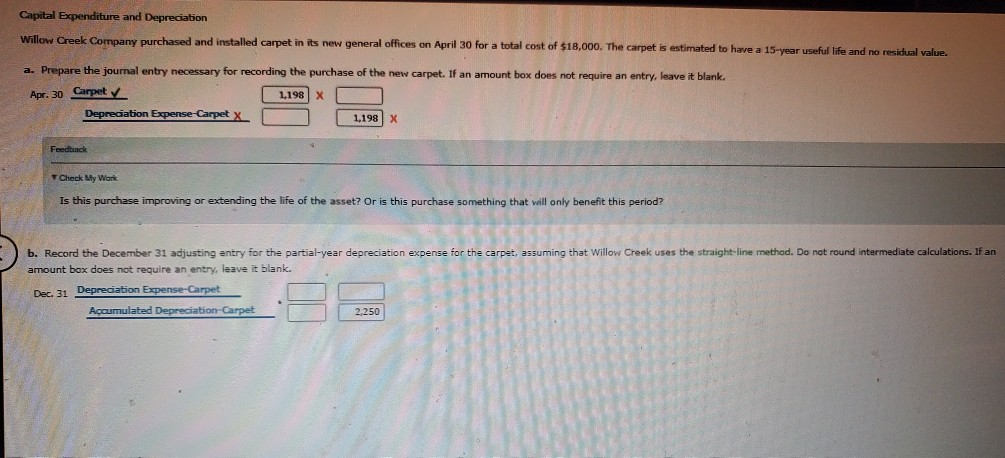

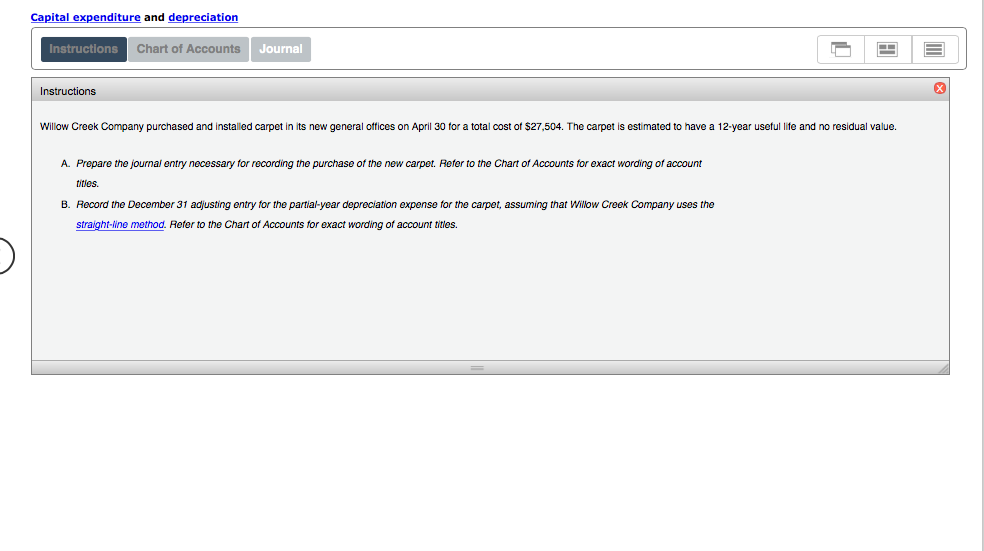

Depreciated value carpet. If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years. Carpet life years remaining. If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years. Normal wear and tear.

By convention most u s. Beyond that distinction depreciating carpeting is the same as depreciating a new appliance see the more detailed appliance depreciation article above. Tile hardwood linoleum unlike carpeting are usually more or. Value of 2 years carpet life remaining.

100 per year age of carpet. Most other types of flooring i e. Most types of flooring and other capital assets get depreciated by dividing their value by a set number of years called a recovery period. Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

Residential rental property is depreciated at a rate of 3 636 each year for 27 5 years. Every year you take a write off for the amount that you. 10 years 8 years 2 years. 2 years 100 per year 200.

You cannot depreciate land. Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years. Only the value of buildings can be depreciated.