Depreciable Life Carpet Rental Property

100 per year age of carpet.

Depreciable life carpet rental property. This applies however only to carpets that are tacked down. You can take depreciation on anything that contributes to the long term value of your rental property. Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred. Repairing after a rental disaster.

If you improve depreciable property you must treat the improvement as separate depreciable property. But the irs classifies that with appliances for 5 years. Depreciation commences as soon as the property is placed in service or. 10 years 8 years.

Since these floors are considered to be a part of your rental property they have the same useful life as your rental. Carpet life years remaining. I could see that for a rental property because in general a renter doesn t take care of the property like they would if they owned it. Improvement means an addition to or partial replacement of property that is a betterment to the property restores the property or adapts it to a new or different use.

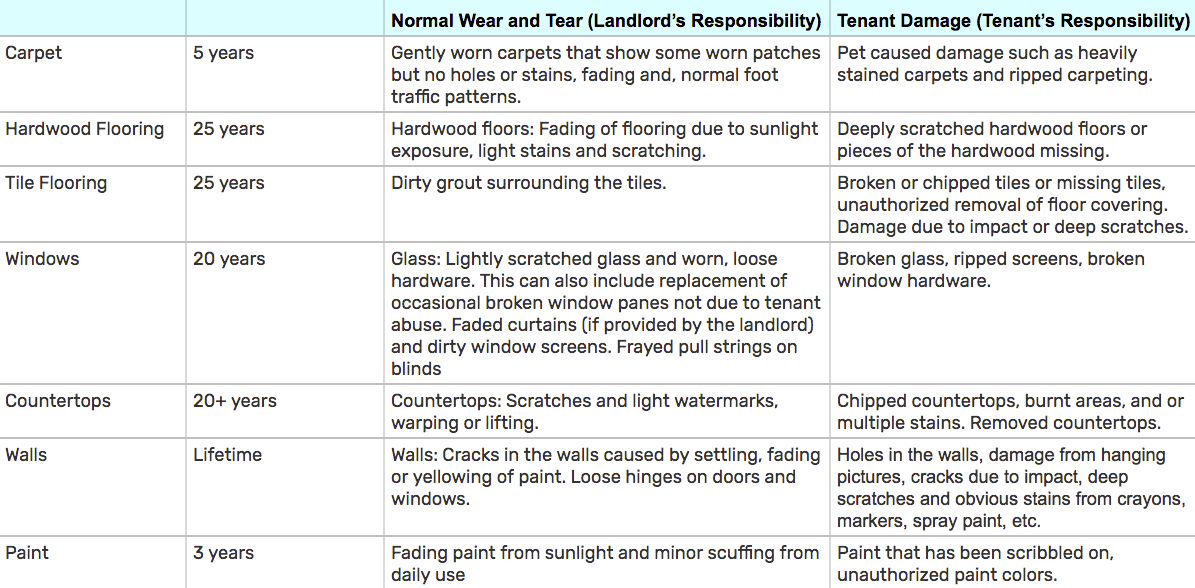

Like appliance depreciation carpets are normally depreciated over 5 years. That means if you have a property worth 200 000 you can deduct 7 272 72 per year as an expense. The landlord should properly charge only 200 for the two years worth of life use that would have remained if the tenant had not damaged the carpet. The real life expectancy of a descent carpet is 10 years.

Rental property owners use depreciation to deduct the the purchase price and improvement costs from your tax returns. When using a nonrecovery method the life or class life is a mandatory entry. If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years. A mid quarter convention must be used if the mid month convention doesn t apply and the total depreciable basis of macrs property placed in service in the last 3 months of a tax year excluding nonresidential real property residential rental property and property placed in service and disposed of in the same year is more than 40 of the.

These types of flooring include hardwood tile vinyl and glued down carpet. Under the general depreciation system gds most tangible property is assigned to one of eight main property classes. Expected life of carpet. See section 1 263 a 3 of the regulations.

Original cost of carpet.