Deductions Not Subject To 2 Floor

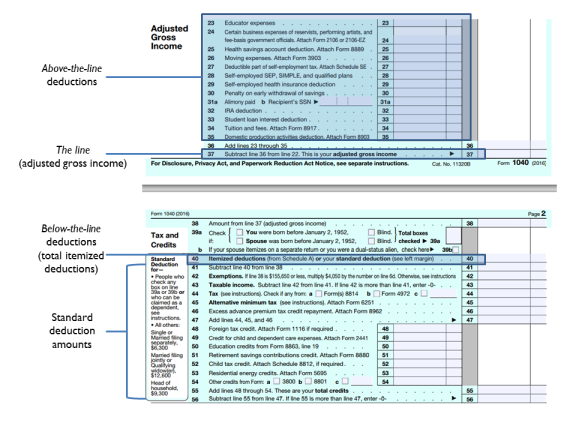

To figure the amount of your allowable deduction for these expenses the irs provides a section on schedule a job expenses and certain miscellaneous deductions.

Deductions not subject to 2 floor. For deductions that are subject to the 2 rule you may only deduct the part of the expenses that exceeds 2 of your adjusted gross income agi. Examples of itemized deductions not subject to the 2 floor include costs related to fiduciary income tax returns and estate tax returns probate court costs and certain appraisal fees. The regulations will apply to tax years beginning on or after may 9 2014. These porfolio deductions are not subject to the 2 floor.

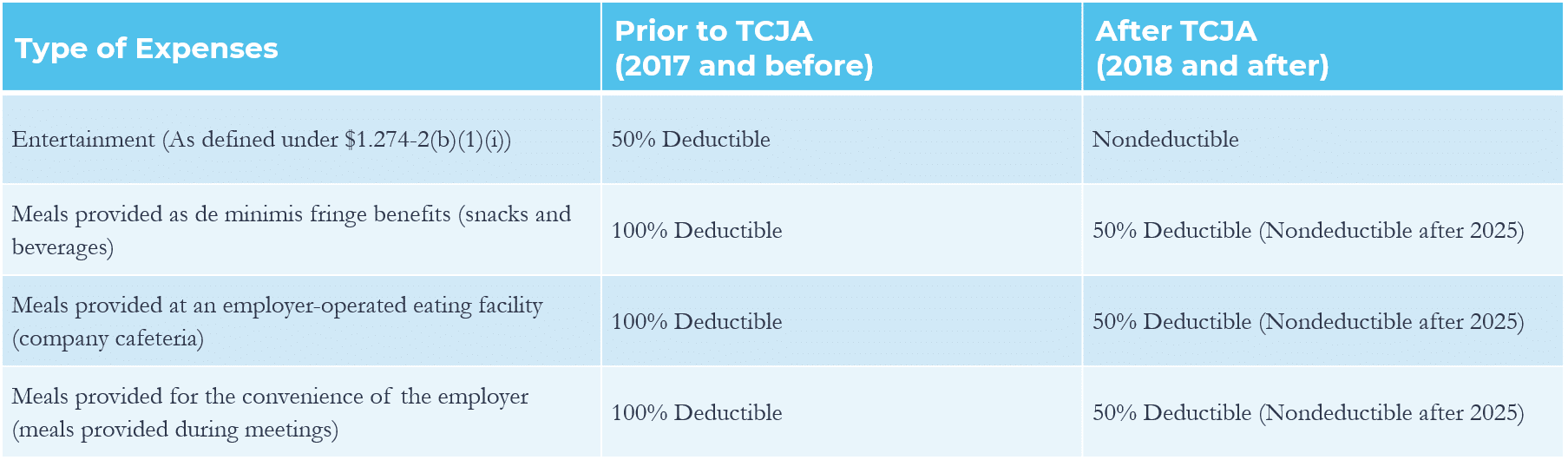

You can still claim certain expenses as itemized deductions on schedule a form 1040 1040 sr or 1040 nr or as an adjustment to income on form 1040 or 1040 sr. Miscellaneous itemized deductions subject to the 2 floor aren t deductible for tax years 2018 through 2025. This publication covers the following topics. This code has been deleted.

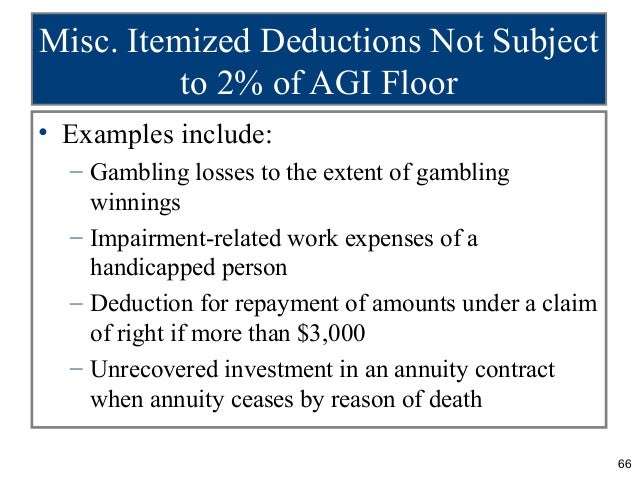

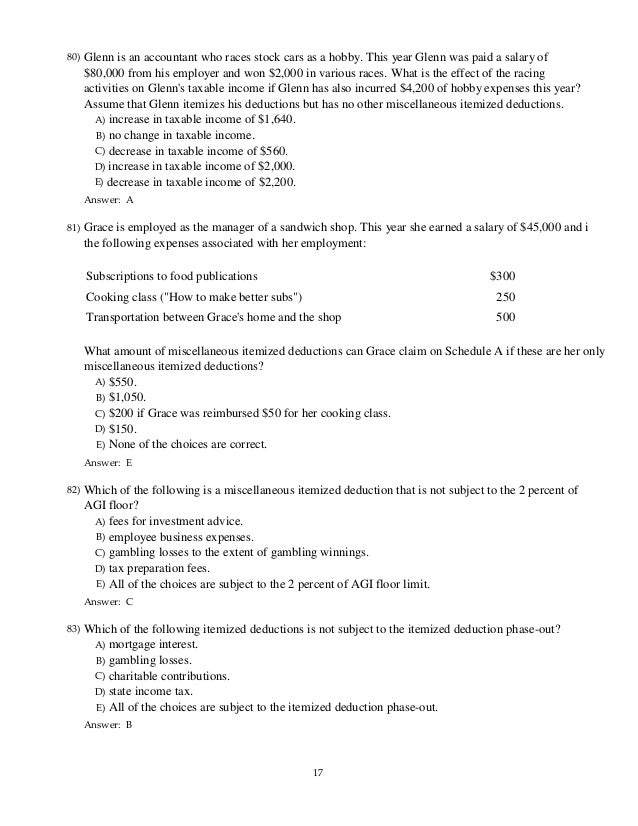

A type of expenses subject to the floor 1 in general. With respect to individuals section 67 disallows deductions for miscellaneous itemized deductions as defined in paragraph b of this section in computing taxable income i e so called below the line deductions to the extent that such otherwise allowable deductions do not exceed 2 percent of the individual s adjusted gross. 2 percent floor on miscellaneous itemized deductions. These losses are not subject to the 2 limit on miscellaneous itemized deductions.

Deductions in excess of income in the final year of a trust or estate pass through to beneficiaries as miscellaneous itemized deductions even if the expenses. In prior years amounts subject to the 2 floor on line 13 of sch k 1 would have been coded with a k. However deductions under section 67 e 1 continue to be deductible if they are costs that are incurred in connection with the administration of an estate or a non grantor trust that would not have been incurred if the property were. Miscellaneous deductions are deductions that do not fit into other categories of the tax code.

Miscellaneous itemized deductions are those deductions that would have been subject to the 2 of adjusted gross income limitation. 2 percent floor on. Thus you should not need to make additional entries as other current year decreases. You must report the full amount of your winnings as income and claim your losses up to the amount of winnings as an itemized deduction.

There are two types of miscellaneous deductions. Shall prescribe regulations which prohibit the indirect deduction through pass thru entities of amounts which are not allowable as a deduction if paid or incurred directly by an individual and which contain such reporting requirements as may be.